Conscious Spending Plan for Individuals with ADHD

Hey there! I get it—managing money when you’ve got ADHD can feel like a game of Whac-A-Mole. But don’t worry. As someone who’s enthusiastic about offering solutions for people with ADHD, I’ve got some real-world advice that could be a game-changer. So, let’s get down to business to achieving a Conscious Spending Plan!

Introduction – Conscious Spending Plan

When you’re dealing with ADHD, life is already a roller coaster. Add finances into the mix, and it’s like riding that roller coaster blindfolded. That’s why I want to share with you the concept of a “Conscious Spending Plan,” specifically tailored for those of us navigating life’s ups and downs with ADHD.

What is a Conscious Spending Plan?

The Basics

Conscious spending is not your average budgeting; it’s budgeting on steroids. It involves making choices about what to spend your money on with awareness and intent. Think of it as a GPS for your finances. You wouldn’t just drive aimlessly without a destination, right? Similarly, conscious spending helps you direct your money where you actually want it to go.

Why It Matters

Conscious spending aligns your spending with your core values and priorities. Think of your money like the battery life on your phone. You wouldn’t want to waste it on apps that you don’t really use, would you? In the same way, you want your money to go toward things that genuinely enrich your life.

The ADHD Factor

Financial Challenges with ADHD

Managing money can be especially challenging for those of us with ADHD. Symptoms like impulsivity, forgetfulness, and even hyperfocus can significantly influence our financial behavior. It’s not uncommon to make impulsive purchases or forget about bills until it’s too late.

How ADHD Affects Spending Behavior

ADHD can make us susceptible to impulse buys and random splurges, often leading to what I call a “financial hangover”—that sinking feeling you get when you realize you’ve overspent, yet again. Trust me, I’ve been there too.

Why a Conscious Spending Plan is Essential for ADHD

Creating a conscious spending plan provides the structure needed for managing finances, but with the flexibility that’s crucial for those of us with ADHD. It’s like having a personal trainer for your wallet—it keeps you on track without making you feel confined.

Step-by-Step Guide to Create a Conscious Spending Plan

Assess Your Financial Status

First things first. You can’t create a roadmap if you don’t know where you’re starting from. Take a comprehensive look at your income, expenses, and debts. Use spreadsheets, apps, or good old pen and paper—whatever works best for you.

Prioritize Your Needs

Now, make a list of your priorities. Which spending categories are non-negotiable? Rent, utilities, groceries—these are your essentials. But also consider things that genuinely improve your quality of life, whether it’s a Netflix subscription or a gym membership.

Budget for Essentials

Once you’ve identified your needs, allocate funds specifically for them. This isn’t the fun part, but it’s crucial. Remember, paying your bills on time is non-negotiable.

Allocate for Fun and Savings

After essentials, the remaining amount is for discretionary spending and savings. Yes, you can still have fun and save even if you have ADHD!

Use ADHD-Friendly Tools

Choose tools that complement your ADHD traits. Apps like YNAB ($84/year) or analog methods like the envelope system are fantastic.

Top ADHD-Friendly Budgeting Tools – Conscious Spending Plan

Apps

Apps like Mint (Free) or GoodBudget are excellent for tracking expenses. They are intuitive and offer real-time updates, making budget management almost effortless.

Analog Solutions

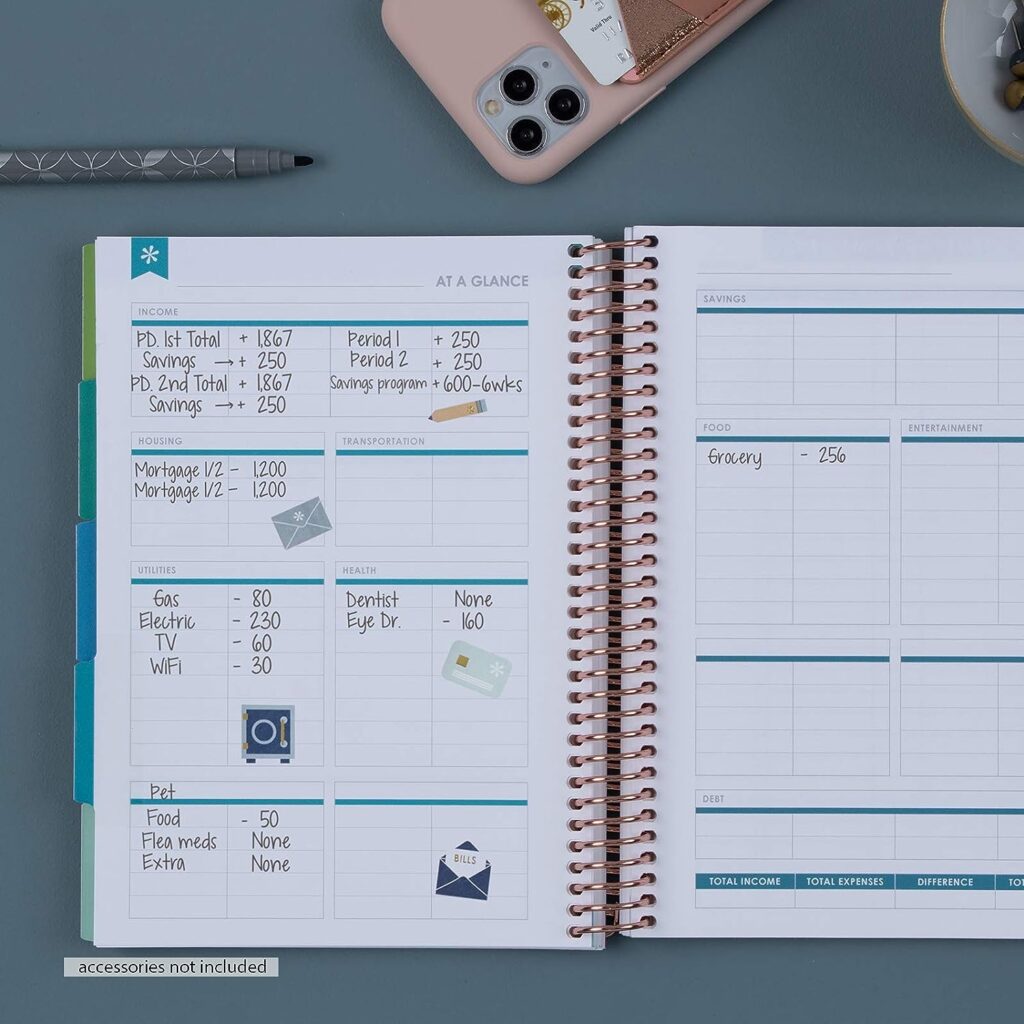

If you’re more of a hands-on person, consider physical planners. The Erin Condren Budget Book, is a popular choice. It’s like having a personal finance coach right in your backpack!

Erin Condren Coiled A5 Planner – Budget Book, Perfect for Easy, Effortless Budgeting, Featuring Savings Tracker, Spending Summaries, Debt Trackers, and More. Boost Productivity

Tips to Stick to Your Plan

- Set reminders: Use your phone to set reminders for bill payments or even weekly check-ins on your budget.

- Make it fun: Use stickers, colors, or any creative method that makes budgeting enjoyable.

- Keep it simple: The more complex your system, the less likely you are to stick with it.

Overcoming Common Obstacles

Procrastination – Conscious Spending Plan

This is a big one for us ADHDers. Procrastination can be tackled by using time-management techniques like the Pomodoro Technique. Set a timer for 25 minutes and work on your budget. Then take a 5-minute break. Rinse and repeat.

The Pomodoro Technique—a time-management godsend, especially for those of us with ADHD. Picture this: instead of staring at your budget spreadsheet for hours and feeling overwhelmed, you set a timer for 25 minutes and work in bursts. That’s what the Pomodoro Technique is all about. You work intensely for 25 minutes and then take a 5-minute break to stretch, grab a snack, or just zone out. It’s like interval training for your brain! This approach makes any task, including budgeting, feel less like a marathon and more like a series of short sprints. Plus, it reduces the chance of falling into the abyss of procrastination. For ADHDers, it’s a match made in productivity heaven.

Ticktime Pomodoro Timer, Productivity Timer Cube, Hexagon Magnetic Flip Focus Timer, Mute & Adjustable Sound Alert, for Work, Office, ADHD, Study, Task, 3/5/10/15/25/30min & Custom Countdown – Gray

JRLAJRL 3 Pack Liquid Motion Bubbler Timer Sensory Calming Fidget Toy – Toys for Kids Teenager Adults

Impulse Spending

An excellent trick to avoid impulse spending is to impose a 24-48 hour waiting period on yourself for any non-essential purchase. Often, the urge to buy will pass.

Success Stories

I’ve witnessed numerous individuals with ADHD turn their financial life around using these methods. If they can do it, so can you. You’re not alone on this journey, and success is absolutely possible.

Conclusion – Conscious Spending Plan

Creating a conscious spending plan while juggling ADHD might seem like trying to solve a Rubik’s Cube while riding a unicycle, but trust me, it’s entirely achievable. The trick is to find strategies that resonate with you. With the right tools and some perseverance, financial stability is within reach.

FAQs

- What is a Conscious Spending Plan?

- It’s a budgeting strategy tailored to align with your unique needs and priorities.

- How does ADHD affect my spending?

- ADHD symptoms can lead to impulsive purchases and neglect of regular financial responsibilities.

- What are some ADHD-friendly budgeting tools?

- Apps like YNAB, Mint, or even physical planners like the Erin Condren Budget Book.

- How do I overcome procrastination while budgeting?

- Techniques like Pomodoro can be effective.

- Is it costly to implement a Conscious Spending Plan?

- No, there are free and low-cost tools available to help you start your conscious spending journey.

And there you have it—a guide tailored just for us, the vibrant, often scatterbrained, yet ever-so-resourceful people with ADHD. Now go own your financial future!

*We may earn a commission for purchases made using our links. Please see our disclosure to learn more.